STATUTORY DISCLOSURES

Licensed Financial Service Provider FSCA No. 31330

Licensed Financial Service Provider FSCA No. 31330

Financial Service Provider’s Information

Financial Intelligence Centre Act (FICA)

In terms of FICA, Lentus Asset Management (Pty) Ltd is an accountable institution. We are required to identify our prospective clients, verify the given information, and keep records of such documents. We are also obliged to report suspicious and unusual transactions that may facilitate money laundering to the relevant authorities.

Disclaimer

Lentus Asset Management (Pty) Ltd is an authorised financial services provider under the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002) FAIS (FSP number: 31330). Past performance is not necessarily indicative of future performance. Buying and selling of financial products entails risk, please ensure that you are always appropriately advised and aware of all risks involved. No guarantee as to the investment value or performance of any financial product is given or should be inferred. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. Illustrations, forecasts, or hypothetical data are not guaranteed and are provided for illustrative purposes only. This document does not constitute a solicitation, invitation, or investment recommendation. We do not imply that any specific financial product is suitable. Prior to selecting a financial product or portfolio in which to invest, it is recommended that investors seek independent, specialised financial, legal and tax advice in this regard. Hedge Funds are collective investment schemes to which the prescribed provisions of the Collective Investment Schemes Control Act (Act 45 of 2002) apply. The laws of the Republic of South Africa shall govern any claim relating to or arising from the contents of this document.

Authorised representatives and key individuals

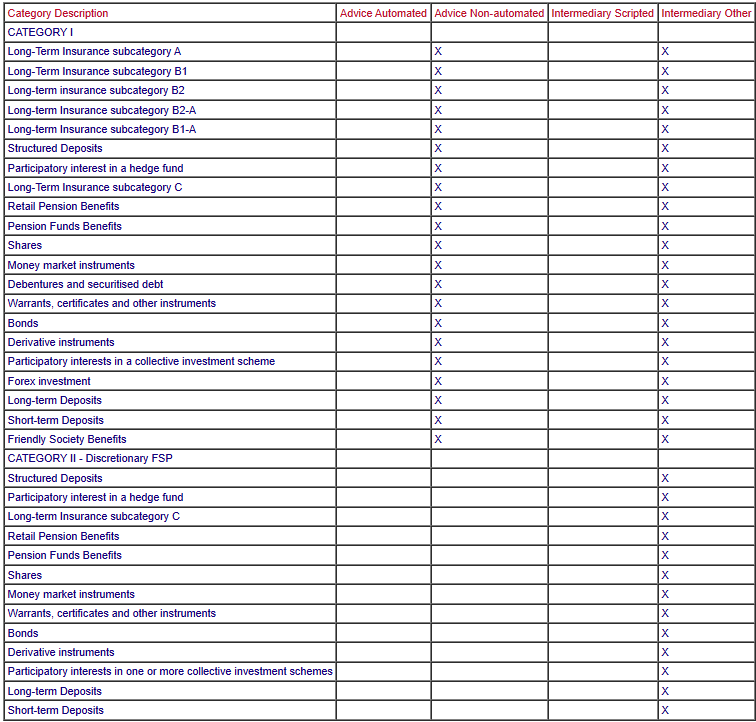

The Financial Services Conduct Authority has duly authorised representatives to render financial services as defined in terms of the Financial Advisory and Intermediary Services (FAIS) Act in respect of the below financial products:

The FSP confirms that its key individual (s) and representative(s) are mandated and entitled to render financial advice and / or intermediary services to you in terms of FAIS. The representatives are remunerated by commission or fees from the product supplier and hereby submit that they did not receive more than 30% of the preceding year’s commission or remuneration from any product suppliers. Our Representatives do not receive cash, or non-cash incentives from product suppliers in line with our conflicts of interest policy, a list of such details is recorded in a register and available at our offices for your perusal. The FSP has a suitable Professional Indemnity in place in accordance with FAIS.

- Business Name

- Lentus Asset Management (Pty) Ltd

- Address

- 23 Dundalk Avenue, Parkview, Gauteng 2122

Financial Intelligence Centre Act (FICA)

In terms of FICA, Lentus Asset Management (Pty) Ltd is an accountable institution. We are required to identify our prospective clients, verify the given information, and keep records of such documents. We are also obliged to report suspicious and unusual transactions that may facilitate money laundering to the relevant authorities.

Disclaimer

Lentus Asset Management (Pty) Ltd is an authorised financial services provider under the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002) FAIS (FSP number: 31330). Past performance is not necessarily indicative of future performance. Buying and selling of financial products entails risk, please ensure that you are always appropriately advised and aware of all risks involved. No guarantee as to the investment value or performance of any financial product is given or should be inferred. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. Illustrations, forecasts, or hypothetical data are not guaranteed and are provided for illustrative purposes only. This document does not constitute a solicitation, invitation, or investment recommendation. We do not imply that any specific financial product is suitable. Prior to selecting a financial product or portfolio in which to invest, it is recommended that investors seek independent, specialised financial, legal and tax advice in this regard. Hedge Funds are collective investment schemes to which the prescribed provisions of the Collective Investment Schemes Control Act (Act 45 of 2002) apply. The laws of the Republic of South Africa shall govern any claim relating to or arising from the contents of this document.

Authorised representatives and key individuals

The Financial Services Conduct Authority has duly authorised representatives to render financial services as defined in terms of the Financial Advisory and Intermediary Services (FAIS) Act in respect of the below financial products:

The FSP confirms that its key individual (s) and representative(s) are mandated and entitled to render financial advice and / or intermediary services to you in terms of FAIS. The representatives are remunerated by commission or fees from the product supplier and hereby submit that they did not receive more than 30% of the preceding year’s commission or remuneration from any product suppliers. Our Representatives do not receive cash, or non-cash incentives from product suppliers in line with our conflicts of interest policy, a list of such details is recorded in a register and available at our offices for your perusal. The FSP has a suitable Professional Indemnity in place in accordance with FAIS.

Product Suppliers

Lentus Asset Management (Pty) Ltd an approved authorised FSP with the relevant knowledge competency and proficiency to market a range of products and is contracted with several service providers within the financial services industry. Below is a list of some of the product providers Lentus Asset Management (Pty) Ltd is contracted and is authorised to sell and market their products. Although we have tried to present you with a comprehensive list this may change:

- Interactive Brokers

- Investec Bank Limited

- Allan Gray

- Sanlam/Glacier

- Standard Bank

- Sygnia

- Sovereign Group

- Old Mutual International

- Liberty

Complaints procedure

A complaint procedure has been implemented, which is available on request. If you wish to submit a complaint, you may submit the complaint to the following email address: support@lentus.co.za. If you feel that your complaint has not been adequately dealt with you are entitled to submit the complaint to the relevant Ombudsman.

- FAIS Ombud

- Email

- info@faisombud.co.za

- Website

- www.faisombud.co.za

- Telephone number

- (012) 762 5000

- Sharecall

- 086 066 3247

- Physical Address

- Menlyn Central Office Building, 125 Dallas Avenue, Waterkloof Glen, Pretoria, 0010

- Postal Address

- PO Box 41, Menlyn Park, 0063

- Email

- Long-Term Insurance Ombudsman

- Email

- info@ombud.co.za

- Website

- www.ombud.co.za

- Telephone

- (021) 657 5000

- Sharecall

- 086 010 3236/(021) 674 0951

- Physical address

- Claremont Central Building, 6th Floor, 6 Vineyard Road, Claremont, 7700

- Email

- Information regulator

- Email

- PAIAComplaints@inforegulator.org.za

- POPIAComplaints@inforegulator.org.za

- Website

- www.justice.gov.za/inforeg/contact.html

- Physical address

- JD House, 27 Stiemens Street, Braamfontein, Johannesburg, 2001

- Postal address

- PO Box 31533, Braamfontein, Johannesburg, 2017

- Email

Treating Customers Fairly

The FSP abides by Treating Customers Fairly (TCF), the Protection of Personal Information Act (POPIA) and the Promotion of Access to Personal Information Act (PAIA). All relevant policies are available upon request.

Conflict of interest

In accordance with the FSP’s Conflicts of Interest Management Policy, the FSP places a high priority on its clients’ interests. As conflicts of interest could undermine the integrity and professionalism of the FSP and its employees, any potential or recognized instance must be identified as early as possible. Potential conflicts of interest are inherent in any business and therefore it is not the aim of the FSP to avoid all conflicts. If conflict situations cannot be avoided, the FSP will manage equitably and in the client’s interest as an integral part of the FSP’s duties and obligations. The FSP maintains an active Conflicts of Interest Management Policy, which is available on request.

Important information - Client confirmation and understanding

- Any financial analysis/recommendation is based on the information supplied by the client is assumed to be correct. Although reasonable efforts have been made to substantiate information supplied by third party sources, where applicable, Lentus Asset Management (Pty) Ltd does not accept liability for losses, whatever nature, arising from any incorrect information supplied.

- It is therefore important that all relevant information maintained or recorded by Lentus Asset Management (Pty) Ltd is true and valid and that any changes are communicated to the financial advisor or FSP of any inaccuracies or omissions.

- Clients should also ensure that all characteristics of the product recommended, such as benefits and features included and excluded, any cover limitations that apply and the risk incidental to the specific products are clearly understood.

- Clients should not follow any recommendation made unless all the specific characteristics of the product are understood.

- Kindly note that any analysis is based on current data, rates, and classifications. Due to the volatility of certain investment markets and the changeability of rates and classifications, the analysis/recommendation may become inappropriate due to subsequent changes in the markets, rates and/or classifications. Clients should therefore ensure that that they only act upon an updated recommendation/analysis.

- Due to constant changes in the economic environment and changes regarding the client's personal needs and objectives the client ought to review their financial position at regular intervals.

- It is important that the client is sure that the product and transactions meet relevant needs and that that they feel they have all necessary information to enable them to make an informed decision.

- Waiver of rights: no representatives of the provider or any other person may ask the client, or offer any inducement to the client, to waive any right or benefit conferred on the client by or in terms of any provision of the FAIS Act. Note further that no representative has a right to enter any contractual obligation on the client’s behalf, or to restructure portfolios without the client’s prior written consent.

Lentus Asset Management (Pty) Ltd is an authorised financial services provider.

FSP No. 31330.

2025

FSP No. 31330.

2025